Die Archivierung von Dokumenten erfolgt regelmäßig, nachdem der dazugehörige Geschäftsvorfall abgeschlossen ist. Dokumente zu archivieren bedeutet dabei, sie langfristig sicher und unveränderbar aufzubewahren. Bisher geschieht dies in Papierform und in Aktenordnern oder Kartons. Mit Archivierungssoftware kann dies elektronisch als digitale Ablage erfolgen.

Was ist bei der Archivierung von Dokumenten zu beachten? Brauche ich noch Papier und Aktenordner? Gibt es eine Aufbewahrungsfrist für Dokumente? Diese und weitere Fragen beantworten wir Ihnen auf dieser Seite. Außerdem erklären wir Ihnen welche Vorteile das elektronische Archivieren von Dokumenten hat und geben Ihnen Tipps, wie Sie dies für Ihr Unternehmen optimal nutzen.

Sollten Sie sich bereits mit der Archivierung von Dokumenten vertraut gemacht haben und eine Archivierungssoftware suchen, so zeigen wir Ihnen gerne wie schnell und einfach Sie humbee als Dokumentenmanagement Software einsetzen können.

Inhaltsverzeichnis

Dokumente archivieren

Wenn über das Archivieren von Dokumenten gesprochen wird denken viele an das papierlose Büro. Alle Unterlagen, die in Papierform vorliegen, müssen eingescannt werden. Andere denken dabei in Bezug auf E-Mails an die Auto-Archivierung von Outlook.

Dabei fallen im Alltag viele unterschiedliche Dateitypen an, die wir archivieren wollen oder sogar müssen. Dies können neben der E-Mail auch PDF, Word- oder eine Exceldatei, aber auch ein Bild, eine Zeichnung oder andere Multimedia Dateien wie ein Video- oder ein Audiofile sein.

Digitale Dokumente bringen viele Vorteile

Wäre es nicht schön, wenn alle diese Informationen automatisch archiviert und jedem Vorgang zugeordnet würden. Ihre Mitarbeiter könnten dann viel schneller auf relevante Informationen zugreifen und effektiver arbeiten.

Reduzierte Suchzeiten

Häufig werden elektronische Dokumente in der gleichen Systematik archiviert wie Papierdokumente. Hier gibt es eine hierarchische Ablage z.B. in der Form Kunde – Jahr – Dokumenttyp. Der Zugriff ist also beschränkt auf die in der Ablage definierte Struktur. Suche ich also nach einer Rechnung Nr. 4711 des Kunden Müller KG, suche ich erst nach dem Kunden, dann muss ich wissen, aus welchem Jahr die Rechnung stammt, bevor ich die Rechnungen finde.

Die elektronische Archivierung von Dokumenten bietet hier erweiterte Möglichkeiten. In einem Aktenplan werden zunächst die Dokumenttypen festgelegt. Dies sind z.B. Rechnungen, Lieferscheine oder Verträge. Diesen werden dann Attribute zugeordnet. So beispielsweise der Kunde, das Jahr, die Rechnungs- und Auftragsnummer, der Rechnungsbetrag oder eine Kündigungsfrist im Fall von Verträgen. Dokumente unterschiedlichen Typs mit gleicher Auftragsnummer werden dann zu einer elektronischen Auftragsakte zusammengefasst.

Mitarbeiter können nun entweder nach der Auftragsakte suchen oder nach einer beliebigen Kombination von Dokumententyp und Attribut suchen. Sie können z.B. nach allen Verträgen mit dem Kunden Müller KG suchen, die innerhalb der nächsten zwei Jahre auslaufen. Auf diese Weise haben Sie einen deutlich erweiterten Zugriff auf Dokumente als im alten System der Aktenschränke, Regale und Hängeregister.

Elektronisch archivierte Dokumente bieten also folgende Vorteile bei der Suche:

Die elektronische Archivierung von Dokumenten auf Basis eines Aktenplanes ist inzwischen ein veraltetes System, welches jedoch in vielen DMS Systemen noch immer gang und gäbe ist.

Ablage in Vorgängen

Moderne DMS Systeme ermöglichen die Dokumentenarchivierung zusätzlich in Vorgängen. Vorgänge entsprechen einem Geschäftsvorfall bzw. einem Geschäftsprozess. Der Vorteil gegenüber der reinen Archivierung von Dokumenten oder digitalen Akten besteht in der Möglichkeit neben Dokumenten auch Aufgaben und Notizen sowie die innerbetriebliche und externe Kommunikation im Vorgang zu speichern. Außerdem verfügen Vorgänge regelmäßig über ein Statusmodell.

Vorgangsbezogene Ablage bietet also erheblich erweiterte Bearbeitungsmöglichkeiten und stellt dem Anwender alle prozessbezogenen Informationen, nicht nur die Dokumente zur Verfügung.

Erweiterte Suchmöglichkeiten

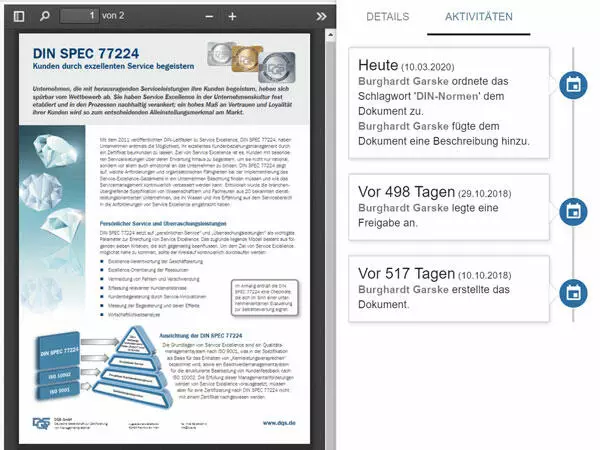

Mit einer Archivierungssoftware, die fester Bestandteil eines Dokumentenmanagement Systems ist, können sogenannte Schlagwörter zu jedem Dokument hinterlegt werden. In modernen Systemen, die auch die Abbildung von Vorgängen beherrschen, können Schlagworte auch den Vorgängen zugeordnet werden.

Schlagworte erweitern Ihre Suchmöglichkeiten. So können einem Dokument die Schlagworte Weiterbildung, Fortbildung und Qualifikation zugeordnet werden. Anwender verwenden für die Suche unterschiedliche Begriffe für die gleiche Sache. Daher steigt durch die Verwendung von Schlagworten die Chance, das relevante Dokument in der Archivierungssoftware wiederzufinden erheblich.

Mit Hilfe von OCR und fortschrittlichen Erkennungstechnologien gewinnt moderne Archivierungssoftware neben dem Volltext auch Schlagworte automatisch beim Scannen.

Reduzierte Bearbeitungszeit

Bei klassischer Archivierungssoftware finden Sie schnell und zielsicher Ihr benötigtes Dokument. Metadaten und Schlagwörter lassen sich den Dokumenten automatisiert zuweisen. Mit einer modernen ECM Software wie humbee, können Sie noch mehr Zeit einsparen. Denn hier haben Sie nicht nur schnellen Zugriff auf einzelne Dokumente, sondern auf alle Informationen zu einem Vorgang. Das zeitaufwändige Suchen von Dokumenten entfällt vollständig.

Zusätzlich bietet Ihnen ein modernes ECM System auch die umfangreiche Bearbeitung Ihrer Vorgänge. Sie reduzieren also nicht nur die Suchzeiten, sondern optimieren Ihre Bearbeitungszeiten und werden so effizienter.

Auch bietet Ihnen humbee viele Automatisierungsmöglichkeiten mit Hilfe von Workflows.

Zusammenarbeit

Durch die richtige Zusammenfassung aller Information in einem Vorgang erleichtert Ihnen ein modernes ECM System wie humbee auch die Zusammenarbeit mit Ihren Kollegen. Alle Anwender, die Zugriff auf einen Vorgang haben, haben denselben Kenntnisstand.

Sie können nicht nur Dokumente erstellen, bearbeiten, prüfen und freigeben. Sie können darüber hinaus Aufgaben erstellen und delegieren und sogar Externe in die Bearbeitung von Vorgängen einbeziehen. Mit Hilfe von automatisierten Workflowschritten steigt die Effizienz und Prozesssicherheit.

Die Sicherheit Ihrer Daten ist lebenswichtig

Revisionssichere Archivierung

Der Begriff Revisionssichere Archivierung wird im Bereich der digitalen Archivierung von Dokumenten häufig angetroffen. In der Tat wird der Begriff in gesetzlichen Vorgaben nicht angetroffen.

Dennoch ist er insofern von Bedeutung, dass er Elemente einer rechtssicheren Archivierung zusammenfasst. Im Sinne der GoBD, den Grundsätzen zur ordnungsmäßigen Führung und Aufbewahrung von Büchern, Aufzeichnungen und Unterlagen in elektronischer Form sowie zum Datenzugriff (GoBD), steht revisionssichere Archivierung für die Nachvollziehbarkeit von Änderungen am digitalen Datenbestand.

Die GoBD gehen weit darüber hinaus. Im entsprechenden Schreiben des Bundesministeriums der Finanzen vom 28.11.2019 werden die Anforderungen der Finanzbehörden an die betrieblichen Verfahren im Rahmen der digitalisierten Belegverarbeitung in 19 Kapiteln detailliert beschrieben.

Grundsätzlich wird hier klargestellt, dass die Führung digitalisierter Bücher und die Digitalisierung von Belegen zulässig ist. Hierzu müssen Sie die Vorschriften der GoBD einhalten und die Dokumentenarchivierung revisionssicher gestalten.

Besonders hervor zu heben ist die Beachtung der gesetzlichen Aufbewahrungspflichten und die Pflicht zur digitalen Langzeitspeicherung von E-Mails. Es ist nicht richtig, handelsrechtliche relevante Mails auszudrucken und analog weiter zu verarbeiten.

Bemerkenswert ist auch die Feststellung, dass Zertifikate hinsichtlich der GoBD Konformität von Software keinerlei rechtliche Wirkung gegenüber dem Finanzamt entfalten.

Bedeutung für Unternehmen

Unternehmen sollten sich mit dem Schreiben des BMF auseinandersetzen. Hier werden die Anforderungen der GoBD an die rechtssichere Aufbewahrung von Dokumenten im Detail dargesetellt. Sie gehen dabei über die reine Aufbewahrungspflicht gegenüber dem Finanzamt hinaus. Die Anforderungen zu erfüllen ist wichtig, allerdings in den meisten Fällen auch unkompliziert. Die Anbieter elektronischer Archivierungslösungen bieten hier hinreichend Funktionalitäten.

Neben den gesetzlichen Anforderungen sollten sich Unternehmen auf die betriebswirtschaftlichen Potenziale digitaler Archivierungslösungen konzentrieren. Dabei sind moderne Verfahren der inzwischen 30 Jahre Archivierungssoftware klassischer DMS Anbieter vorzuziehen. Diese Lösungen, wie z.B. humbee, ermöglichen eine ganzheitliche Unterstützung der betrieblichen Abläufe. Damit erschließen sich Unternehmen hohe Einsparpotenziale.

Welche Dokumente müssen archiviert werden?

Grundsätzlich sind alle Handelsbriefe archivierungspflichtig. So sind z.B. Angebote, Auftragsbestätigungen und Rechnungen gemäß GoBD aufbewahrungspflichtig. Meist vergessen wird, dass auch E-Mails Handelsbriefe sind und insofern genau wie Dokumente zu archivieren sind.

Aus diesem Grund wird im humbee System beispielsweise jede eingehende Mail, die eine Rechnung enthält, automatisch archiviert. E-Mails, die aus Vorgängen verschickt werden, sind auch dort automatisch gespeichert. So können Sie im Sachzusammenhang des Geschäftsvorfalls jederzeit recherchiert werden. Sie gehen nicht in den digitalen Wüsten persönlicher E-Mail-Postfächer verloren.

Wie lange müssen diese Dokumente aufbewahrt werden?

Für die Aufbewahrungsfrist von Dokumenten gibt es rechtliche Vorgaben. Die Aufbewahrungspflichten sind geregelt im HGB § 257 und in der AO § 147. Demnach sind Handelbriefe 6 Jahre aufzubewahren und Handelsbücher, Inventare, Eröffnungsbilanzen, Jahresabschlüsse 10 Jahre aufzubewahren. Hierzu zählen auch Ein- und Ausgangsrechnungen.

Die Fristen beginnen jeweils mit Abschluss des Geschäftsjahres in dem die Belege entstanden sind. Eine Eingangsrechnung, die am 3.4.2022 eingegangen ist, ist bei Ende des Geschäftsjahres am 31.12., bis zum 31.12.2032 aufzubewahren.

Umstellung von Aktenordnern auf digitale Archivierung

An der elektronischen Archivierung von Papierdokumenten führt kein Weg mehr vorbei. Dies geschieht durch Scannen. Sie können die Dokumente mit eigens für diesen Zweck beschafften Scannern scannen oder Sie verwenden einfach die bereits vorhandenen Multifunktionsgeräte.

Die meisten Dokumente erhalten wir dagegen bereits in digitaler Form. E-Mails, PDFs, Word- und Exceldateien sind nur einige Beispiele dafür. Der Aufwand, an allen unterschiedlichen Stellen digital und analog zu suchen ist hoch. Unternehmen, die nicht auf elektronische Archivierung umstellen verlieren somit ihre Wettbewerbsfähigkeit. Alle Dokumente müssen schnell an einer Stelle von jedem Ort aus in wenigen Sekunden zur Verfügung stehen.

Wer die digitale Archivierung lediglich aufgrund gesetzlicher Vorschriften betreibt, verschenkt Potenzial. Insbesondere die Produktivitätsvorteile durch geringe Suchzeiten und verbesserte Prozesse sind hoch. Besonders profitiert der Kundenservice durch eine enorm gesteigerte Auskunftsfähigkeit gegenüber Kunden.

Dies lässt sich zukunftssicher nur mit einem modernen ECM System realisieren, das insbesondere die Vorgangsbearbeitung unterstützt. Archivierungssoftware oder ein klassisches DMS sind alleine nicht mehr zeitgemäß.

Welche Dokumente eignen sich besonders für die digitale Archivierung

Besonders Dokumente, die heute noch in Papierform vorliegen eigenen sich für die digitale Archivierung. Diese Dokumente werden eingescannt und idealerweise mit automatischen Verfahren verschlagwortet und in das DMS System importiert.

Viele Unterlagen liegen bereits in elektronischer Form vor. Diese werden idealerweise über dieselben Verfahren importiert und verschlagwortet wie die Papierdokumente. Das Einscannen entfällt hier natürlich. Folgende Unterlagen und Dokumente eignen sich für die elektronische Archivierung.

- Eingangsrechnungen und Ausgangsrechnungen

- Allgemeine Buchungsunterlagen in der Buchhaltung

- Lieferscheine und Versandpapiere

- Transportscheine

- Projektunterlagen

- Verträge und Bestellungen

- Handelsbriefe und Schriftverkehr

- Berichte und Bilanzen

- Bankbelege

- Spesenabrechnungen und Reisekosten

- Urkunden und Beglaubigungen

Kann man Papier-Dokumente nach der digitalen Archivierung vernichten?

Die meisten kaufmännischen Dokumente können nach dem Scannen und dem rechtssicheren Archivieren vernichtet werden. Sofern die GoBD beachtet werden, müssen Sie beispielsweise Ein- und Ausgangsrechnungen nicht in Papierform aufbewahren.

Bei einigen Dokumenten sollten Sie von der Vernichtung jedoch absehen. Dies betrifft zum Beispiel Arbeitsverträge und Urkunden, die nur im Original und mit handschriftlicher Unterschrift ihren Beweiswert entfalten.

Die Gelegenheit humbee kennenzulernen

Einfach online mit humbee in der Cloud arbeiten.

Testen Sie humbee 30 Tage kostenlos – ohne Verpflichtung, ohne automatische Verlängerung. Auf Wunsch begleiten wir Sie virtuell bei Ihren ersten Schritten in humbee oder Sie starten direkt selbst durch. Sie möchten direkt mit einem Experten sprechen? Dann buchen Sie einfach ein kostenloses Beratungsgespräch.